5.2 Housing Assets

For Australian ADIs, loans to households, and in particular residential mortgages, are the single largest asset class. Owner-occupied and investor housing loans together account for well over 60% of system lending, a concentration that has long been highlighted by APRA and the RBA as a source of both stability and risk.

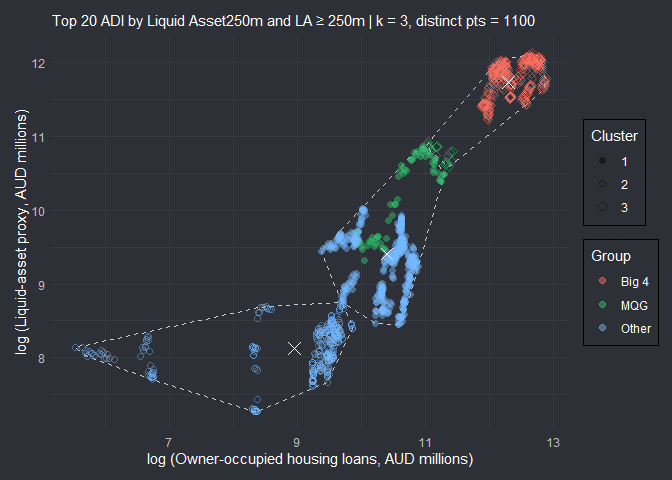

To start I will log transform LA & HA and plot the relationship. I am taking the top 20 ADIs by liquid asset, dropping those without housing exposure above $250 m and a liquid assets of $250 m. I see three distinct groups from the last section, Big 4, Macquarie and the rest. - As a broad generalisation. I plot with those groups coloured and apply k-means clustering to see if the data agrees with me.

Cluster Plot - LA vs HA

A further look at the variance between my assigned groupings (Based on actual ADI) and the k-means cluster shows Macquarie to be between the Big Four and the balance. Similar to the findings when assessing Liquid Asset growth rates. The issue with k-means is that it works best with compact and spherical clusters. Splitting the space into equal sections. An Expecrarion-Maximisation (EM) may work better with the data. - It assigns a probability of each point being assigned to a particular cluster,

| Cluster Assignment vs Known Groups (observation counts) | |||

| Cluster 3 | Cluster 1 | Cluster 2 | |

|---|---|---|---|

| Big 4 | 308 | 0 | 0 |

| MQG | 18 | 59 | 0 |

| Other | 0 | 375 | 340 |

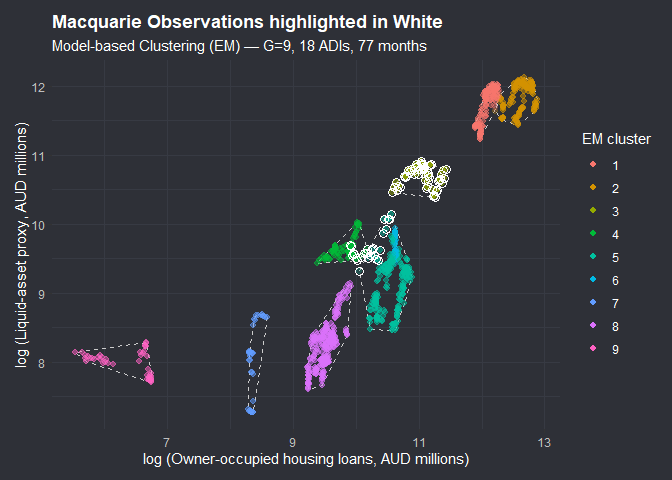

There are clearly other underlying relationships and groupings in the data than my broad generalisation of 3. For now, I am going to try focus on those Macquarie observations that fell outside of cluster 3, to see if there was any significant time factor behind it.

| Macquarie Bank — Cluster Assignment by Year | |||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|

| Cluster 1 | 10 | 12 | 12 | 12 | 6 | 7 | 0 |

| Cluster 3 | 0 | 0 | 0 | 0 | 6 | 5 | 7 |

The table shows that:

2019–2022 Macquarie’s observations were concentrated in Cluster 1, alongside a wide group of smaller ADIs. In this period its liquid asset profile and owner-occupied housing exposures were not yet aligned with the Big 4, placing it statistically closer to the “Other” cohort.

From 2022 onward: MQG drifted into Cluster 1, joining the Big 4. where the Big 4 have remained consistently. This coincided with its step-up in liquid asset holdings — especially the sharp expansion in cash & deposits and investment securities already highlighted in the LA component section.

This may reflect the Term Funding Facility (RBA, 2020–21) and broader liquidity injection resulting in balance sheet expansion for Macquarie. A continuation of the LA component story from the last section.

EM - Model Based Clustering

fitting ...

| | | 0% | |= | 1% | |== | 2% | |=== | 2% | |=== | 3% | |==== | 4% | |===== | 5% | |====== | 6% | |======= | 6% | |======== | 7% | |========= | 8% | |========== | 9% | |=========== | 10% | |============ | 11% | |============= | 12% | |============== | 13% | |=============== | 13% | |================ | 14% | |================= | 15% | |================= | 16% | |================== | 17% | |=================== | 17% | |==================== | 18% | |===================== | 19% | |====================== | 20% | |======================= | 20% | |======================== | 21% | |======================== | 22% | |========================= | 23% | |========================== | 24% | |=========================== | 24% | |============================ | 25% | |============================= | 26% | |============================== | 27% | |=============================== | 28% | |================================ | 29% | |================================= | 30% | |================================== | 31% | |=================================== | 31% | |==================================== | 32% | |===================================== | 33% | |====================================== | 34% | |====================================== | 35% | |======================================= | 35% | |======================================== | 36% | |========================================= | 37% | |========================================== | 38% | |=========================================== | 39% | |============================================ | 39% | |============================================= | 40% | |============================================= | 41% | |============================================== | 42% | |=============================================== | 43% | |================================================ | 43% | |================================================= | 44% | |================================================== | 45% | |=================================================== | 46% | |==================================================== | 46% | |==================================================== | 47% | |===================================================== | 48% | |====================================================== | 49% | |======================================================= | 50% | |======================================================== | 50% | |========================================================= | 51% | |========================================================== | 52% | |=========================================================== | 53% | |=========================================================== | 54% | |============================================================ | 54% | |============================================================= | 55% | |============================================================== | 56% | |=============================================================== | 57% | |================================================================ | 57% | |================================================================= | 58% | |================================================================== | 59% | |================================================================== | 60% | |=================================================================== | 61% | |==================================================================== | 61% | |===================================================================== | 62% | |====================================================================== | 63% | |======================================================================= | 64% | |======================================================================== | 65% | |========================================================================= | 65% | |========================================================================= | 66% | |========================================================================== | 67% | |=========================================================================== | 68% | |============================================================================ | 69% | |============================================================================= | 69% | |============================================================================== | 70% | |=============================================================================== | 71% | |================================================================================ | 72% | |================================================================================= | 73% | |================================================================================== | 74% | |=================================================================================== | 75% | |==================================================================================== | 76% | |===================================================================================== | 76% | |====================================================================================== | 77% | |======================================================================================= | 78% | |======================================================================================= | 79% | |======================================================================================== | 80% | |========================================================================================= | 80% | |========================================================================================== | 81% | |=========================================================================================== | 82% | |============================================================================================ | 83% | |============================================================================================= | 83% | |============================================================================================== | 84% | |============================================================================================== | 85% | |=============================================================================================== | 86% | |================================================================================================ | 87% | |================================================================================================= | 87% | |================================================================================================== | 88% | |=================================================================================================== | 89% | |==================================================================================================== | 90% | |===================================================================================================== | 91% | |====================================================================================================== | 92% | |======================================================================================================= | 93% | |======================================================================================================== | 94% | |========================================================================================================= | 94% | |========================================================================================================== | 95% | |=========================================================================================================== | 96% | |============================================================================================================ | 97% | |============================================================================================================ | 98% | |============================================================================================================= | 98% | |============================================================================================================== | 99% | |===============================================================================================================| 100%

The EM algorithm chose 9 clusters because the of the BIC criterion. This does not mean necessarily that there are 9 distinct groups, no more than there are three groups that I (a) crudely categorised into Big Four (although clear and excepted group), Macquarie and “other” or (b) selected for with k means clustering, showing a variance to (a).

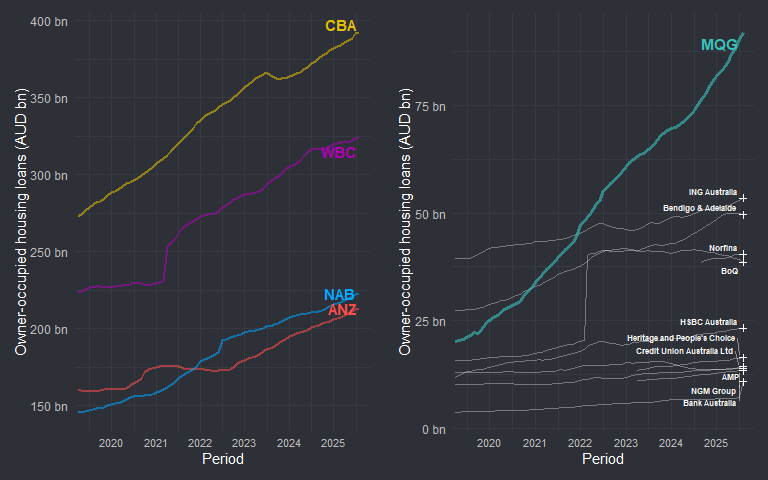

Macquarie’s mortgage expansion aligns with strategic intention—evident from its aggressive market share gains and broker-channel dominance. The chart’s trajectory of Macquarie overtaking “other” ADIs by tens of billions is in direct alignment with their stated performance and strategy.

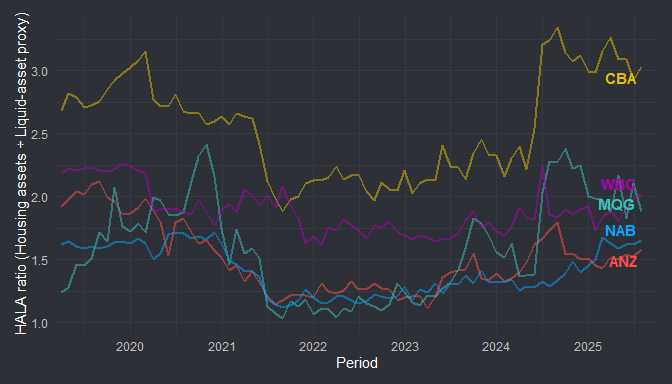

- A higher HALA ratio means a bank carries more housing exposure per dollar of liquid assets. At the underwriting level, this could imply higher liquidity risk if housing portfolios grow faster than balance-sheet buffers.

- International comparisons (e.g. BIS liquidity coverage work, ECB and Fed stress studies) generally view high mortgage-to-liquid-asset ratios as a structural vulnerability: it can constrains flexibility during funding shocks.

- BIS guidance emphasises that housing-concentrated systems should offset with strong HQLA buffers to reduce procyclicality. - Not all liquid assets are made equal.

The HALA profile underscores that institutional appetite and capacity to absorb mortgage growth is not uniform. Borrowers from lenders with higher ratios may be more exposed to macroprudential tightening or liquidity stress scenarios, factors that could influence risk pricing and approval conditions.