3 Market Mechanics

When I arrived to Australia the Treasurer Jim Chalmers led the government’s response to the 2023 RBA Review and legislated the split into a new Monetary Policy Board (MPB) and a Governance Board, clarified the mandate (price stability + full employment under an overarching prosperity objective), and strengthened independence (including removing the old override power) New laws to strengthen and modernise the Reserve Bank pass the Senate (Novmber 2024), Treasury Laws Amendment (Reserve Bank Reforms) Bill 2023. He also appointed Michele Bullock as Governor (Sept 18, 2023) and oversaw the transition to the new boards on a seven year term replacing Philip Lowe RBA Media release, and has chaired the new Monetary Policy Board (as well as the Governance and Payments System Boards) since 1 March 2025, when the reforms commenced .

The MPB has nine members: Governor (Chair), Deputy Governor (Deputy Chair), Secretary to the Treasury (ex-officio), plus six non-executive members appointed by the Treasurer. Current listed members include Michele Bullock, Andrew Hauser, Treasury Secretary Jenny Wilkinson, and externals Marnie Baker, Renée Fry-McKibbin, Ian Harper, Carolyn Hewson, Iain Ross, Alison Watkins. They ordinarily meet eight times a year with regards to setting rates, post-meeting, the decision is announced via media release.

RBA’s model—externals + an ex-official Treasury seat—creates broader perspectives but also a higher variance of outcomes vs insider-only committees (ECB Executive Board + NCB governors; Fed Governors + regional presidents). On independence, the ECB is treaty-anchored: TFEU Article 130 bars EU or member-state bodies from influencing ECB/NCB decision-makers, giving the Council the strongest formal protection of the three Article 130.

The Fed is build on statute and convention: the Federal Reserve Act/FOMC framework delivers operational autonomy with named votes and dissents in each statement, but the chair can still be dragged into politics—as seen in 2025 with Powell repeatedly targeted by Trump, floating the idea of removing Powell Bloomberg, July 2025. Reagarding communications the Fed’s named votes remain the most transparent (statement with recorded dissents); the RBA’s new unattributed counts place it in the middle (decision statement + press conference, with the first “6–3” vote split disclosed in July 2025); the ECB leans on a unified press release and President’s press conference with later accounts and no individual votes. Its still commonplace to hear views from members of any of the institution in the media, Publications Bloomberg, the Financial Times and AFR frequently scrutinise any material from members of Central Banks with a view to discern a signal.

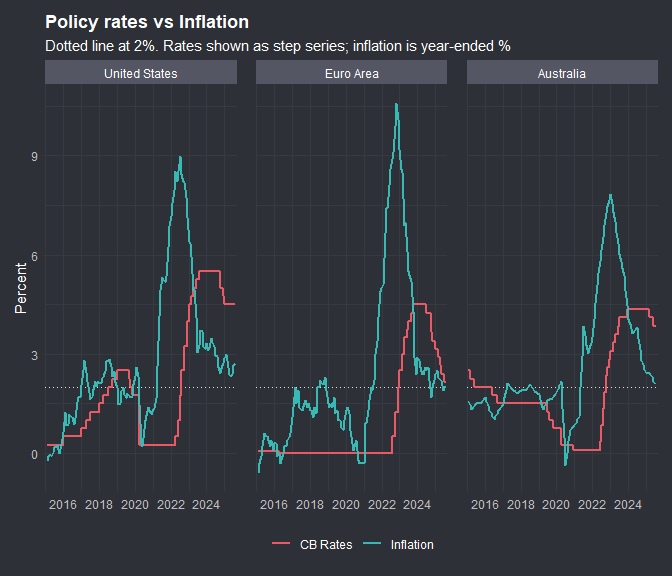

Regarding inflation legislation sets the goals, not the number: price stability (ECB’s TFEU Art. 127; independence in Art. 130) and—for the RBA and the Fed—price stability alongside full employment (Reserve Bank Act; Federal Reserve Act 2A). The numerical inflation target is policy, not statute—e.g., ECB’s symmetric 2% (2021 strategy), the Fed’s 2% longer-run goal, and the RBA’s 2–3% range via the Statement on the Conduct of Monetary Policy—guiding medium-term decisions ECB, FED, RBA.

I’ve loaded rates and inflation data for the three regions using fredr, ecb, readabs and readrba packages.I’ve selected these to display the inflation and rate setting dynamic. There are a suite of different rates or inflation rates I could have selected but these will suffice for comparison. Rate decisions and effective dates don’t naturally align with monthly inflation so some rates are pushed to month end for visualisation.CPI for Australia was interpolated.